Maximise your investment

Join thousands of Australians and save on home loan repayments.

Variable

Tiimely own

5.52%p.a.Interest rate

5.53%p.a.Comparison rate

- No hidden fees

- Free online redraw on any additional repayments

- 20% deposit required

- Unlimited additional repayments

- Up to 30 years loan term

Tiimely own

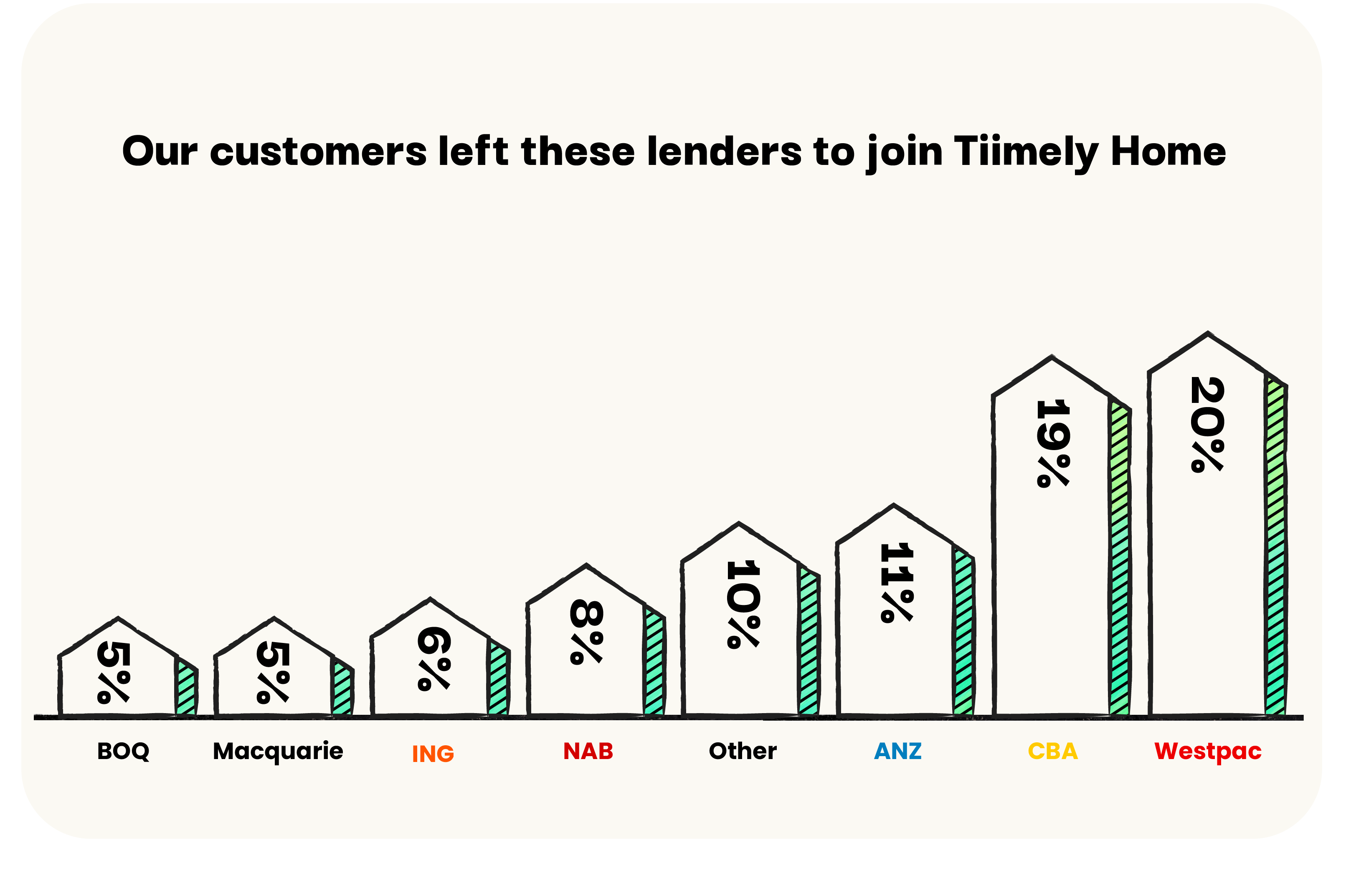

Our customers left these lenders for a Tiimely Own home loan

The graph to the right shows the proportions of lenders that our customers have refinanced from between Jan 1st, 2025, to April 1st, 2025. We use actual encumbrance data in these calculations. This graph is updated quarterly and was last updated on April 1st, 2025.

Variable

Tiimely own

5.52%p.a.Interest rate

5.53%p.a.Comparison rate

- No hidden fees

- Free online redraw on any additional repayments

- Up to 30 years loan term

Fixed 2 Year

Tiimely own

5.49%p.a.Interest rate

5.52%p.a.Comparison rate

- No hidden fees

- Free online redraw on any additional repayments

- Up to 30 years loan term

There's more to love than just low rates

Our award-winning home loans are packed with all the essential features.

Secure, bank-backed offset

We’ve partnered with one of Australia’s biggest banks to give you a 100% offset account that’s government-guaranteed.

Unlimited extra repayments

Get unlimited extra repayments for variable loans and up to $20,000 per year for fixed home loans.

No hidden fees

Our fees are simple and transparent, so you'll always know what to expect. $0 Upfront fees, $0 Monthly Fees (excludes offset), $0 Application Fee, $0 Annual Fees.

Fixed-rate with offset

Unlike most other lenders, we offer a 100% offset account for both our fixed and variable home loans so you can save on interest.

Free redraws

Make extra payments on your loan and reduce your interest, then easily access funds at a later date if you need cash.

Same low rate with a 10% deposit

With Lenders' Mortgage Insurance (LMI), you can borrow up to 90% and get the same rate, no matter your LVR. Don't wait years for a discount.

Real stories, real savings

Hear from our satisfied Tiimely Home customers on Trustpilot.com

Tiimely own

The different kinds of fees

Government fees and charges

No matter what home loan is right for you, be aware of the government fees and charges that may apply during the process.

Talk to a local home loan expert

Get in touch, 7 days a week

We pride ourselves on our service. 90% of customer calls are answered within 20 seconds by our Australian-based team.

HUNGRY FOR NUMBERS?

We have calculators

Get a home loan in 3 easy steps

With a 15 minute online application and fast approvals, getting a home loan is easier than you think.

Check your eligibility

Answer a few questions to see if a Tiimely Own home loan is a good fit for you.

Apply online

It takes 15 minutes to apply. You'll get a decision in minutes or ASAP if we need to jump in manually.

Sign and start saving

If fully approved, your loan docs will be auto-generated and emailed to you. In most cases, within minutes. Then you're ready to celebrate.

Variable

Tiimely own

Investment - Property • Principal and interest

5.59%p.a.Interest rate

5.60%p.a.Comparison rate

Please note if you add an offset account, your comparison rate will change.

Variable

Tiimely own

Investment - Property • Interest only 1 year

5.84%p.a.Interest rate

5.62%p.a.Comparison rate

Please note if you add an offset account, your comparison rate will change.

Fixed 1 year

Tiimely own

Investment - Property • Principal and interest

5.74%p.a.Interest rate

5.61%p.a.Comparison rate

Please note if you add an offset account, your comparison rate will change.

Fixed 1 year

Tiimely own

Investment - Property • Interest only

5.84%p.a.Interest rate

5.62%p.a.Comparison rate

Please note if you add an offset account, your comparison rate will change.