Borrowing power

Home loan borrowing calculator

Run the numbers to get an upfront estimate of your borrowing power.

Tiimely own

You may be able to borrow up to

$000,000

The results of this calculator are an estimate only for Tiimely Own products. LVR-based pricing, eligibility criteria and terms conditions apply, including minimum 10% deposit and below 20% deposit only available where offset home loan is selected (offset facility, Lender's Mortgage Insurance (LMI) and monthly fee will apply). This calculator does not consider HECS debts, which may reduce your borrowing capacity. If you choose a home loan with one of our panel of lenders using a Tiimely Home broker, your borrowing capacity may vary based on your loan options. Learn more about how our calculator works below.

Shop with confidence

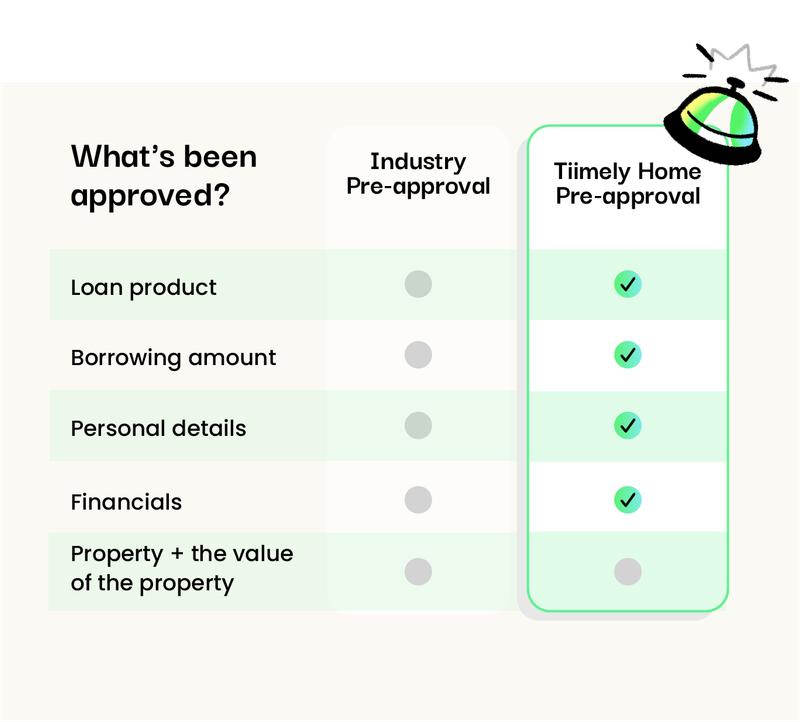

Unlike most lenders, our pre-approval is not simply an indication of what you might be able to borrow. Our pre-approval for our Tiimely Own home loans is everything we can assess without knowing your property. Which means you can plan, budget, inspect and shop with confidence.

Our calculators

Our calculators can help you understand your financial position.

Repayments calculator

Find out what your repayments could be to check if it's within your budget.

Stamp duty calculator

Understand the upfront costs involved with buying a home.

Refinance calculator

Not sure how your rates stack up? Find out how much you could save by refinancing.

Talk to a local home loan expert

Get in touch, 7 days a week

We pride ourselves on our service. 90% of customer calls are answered within 20 seconds by our Australian-based team.

Real customers, real savings

See what satisfied Tiimely Home customers say about us on Trustpilot.com

Frequently asked questions?

Save time with an instant answer

What Is Borrowing Power and How Is It Calculated?

Your borrowing power is an approximate calculation of your ability to borrow funds. Basically, it’s an indication of how much you can afford to borrow while still being able to meet your other financial obligations. Each lender will calculate it differently, but generally, a borrowing power calculator considers things like your income, current loans and liabilities, credit cards and their limits, plus your living expenses. Using our borrowing power calculator will give you an idea of what you could borrow. Learn more about what goes into calculating your borrowing power.

How Do You Calculate My Borrowing Power?

Every lender has their own formula for calculating your borrowing power, and generally there are six main factors:

- Credit rating – a sound credit rating is one of the first things lenders look at, as it is based on your borrowing and repayment history.

- Deposit - the larger your deposit, the more you can borrow and the less interest you’ll have to pay on your loan.

- Income – this is not just how much your household brings in, but how much is left for home loan repayments after the bills and day-to-day expenses are paid.

- Level of debt – how much you owe on other loans, and your credit card limits also influence your available income.

- Savings history – A savings history of at least 3 months demonstrates to a lender that you’ll be able to manage your repayments.

- Home loan term – a lender will look more favourably at a longer loan term, however this means you pay more interest over the life of the loan.

- Property value - a lender may conduct a valuation of your chosen property to determine the amount they're prepared to lend you.

You can get an estimate of your borrowing power with Tiimely Home by using our borrowing calculator.

How Much Deposit Is Required for a Home Loan?

The simple answer is as much as you can possibly save. The larger the deposit you have, the smaller the loan you’ll need which will make the approval process easier and enable you to negotiate a better interest rate and loan terms.

Generally, the minimum home loan deposit required is 10%, but you should try and save at least 20% if you can, because if you borrow more than 80% of a property’s value, your lender may require you to take out Lenders’ Mortgage Insurance.

It’s also worth checking if you’re eligible for any grants or government schemes (such as the First Home Owner Grant), as they can help to boost your deposit amount.

What You Should Know About Lenders Mortgage Insurance (LMI)

Lenders' Mortgage Insurance is insurance that protects the lender from financial loss if you’re not able to make your repayments and default on the loan.

You’ll need to pay LMI if you borrow more than 80% of a property’s value (i.e. if you have less than a 20% deposit).

Factors that affect how much LMI include:

- The size of the loan - the bigger your loan, the higher the LMI

- Your deposit amount - the smaller the deposit, the higher the cost of LMI

- The purpose of the loan – investors can pay as much as 20% more for LMI than owner occupiers

- Your employment status – how much you earn and whether your work is full time or casual

- The insurer - premiums differ between insurers

LMI can cost you thousands of dollars, however there are ways to avoid paying LMI or reducing how much you pay including:

- Ensuring your deposit is 20% or as large a deposit as possible to lower the LMI premium

- Having a guarantor on your loan (Tiimely Own home loans don't offer guarantor loans, however our brokers can assist you in finding a suitable guarantor loan)

- Applying for the Home Guarantee Scheme (HGS), eligible first-home buyers to borrow up to 95% of the property value without paying LMI

Does A Bigger Deposit Affect My Borrowing Capacity?

In short, no. However, your maximum purchase price may increase if you have a higher deposit.

When assessing your borrowing power, we look at your ability to comfortably meet repayment requirements. Your income, expenses, other financial commitments and also your living situation (e.g. de facto, single, dependents), all impact on how much you can borrow.

Using our borrowing calculator will give you an idea of what your borrowing power.

Learn more about what goes into calculating your borrowing power.

How can I increase my borrowing power?

You can increase your borrowing power by reducing your financial commitments.

Things like closing unused credit cards or reducing the limits or having extra income (like a second job or side hustle) can help. Also, make sure that you have all your extra income types (like overtime or commission) included when filling out an application.

Using a borrowing calculator can also help give an estimation of what you could borrow.

Related content

How this borrowing calculator works

How do you calculate borrowing capacity

This borrowing calculator is a guide only, and gives you an estimate of how much you could borrow with Tiimely Home, based on the income and expenses you entered, our current Tiimely Own home loan interest rates and an assumed loan term of 30 years. It is not credit approval. You’ll still need at least a 10% deposit (and for deposits below 20% Lender’s Mortgage Insurance (LMI) is applicable).

We’re responsible lenders, so we calculate your borrowing power using the higher of your estimated expenses and your HEM (Household Expenditure Measure – an Australian average expenditure benchmark). Find out more about borrowing power.

You’ll get a qualified assessment when you begin an application, and enter the specifics of the property, your loan type, personal details and your financials. Find out more about our eligibility criteria.

Important information about our borrowing calculator

There are a lot of different factors that go into calculating how much you can borrow for a home loan. We’ve designed our borrowing calculator to be a faster and simpler way to get an estimated answer. Every lender has their own way of calculating borrowing power so you might get different results with other home loan calculators. Our home loan borrowing calculator takes into account the type of loan you’re applying for, your income, and your expenses to give you an idea of how much you can expect to be able to borrow.