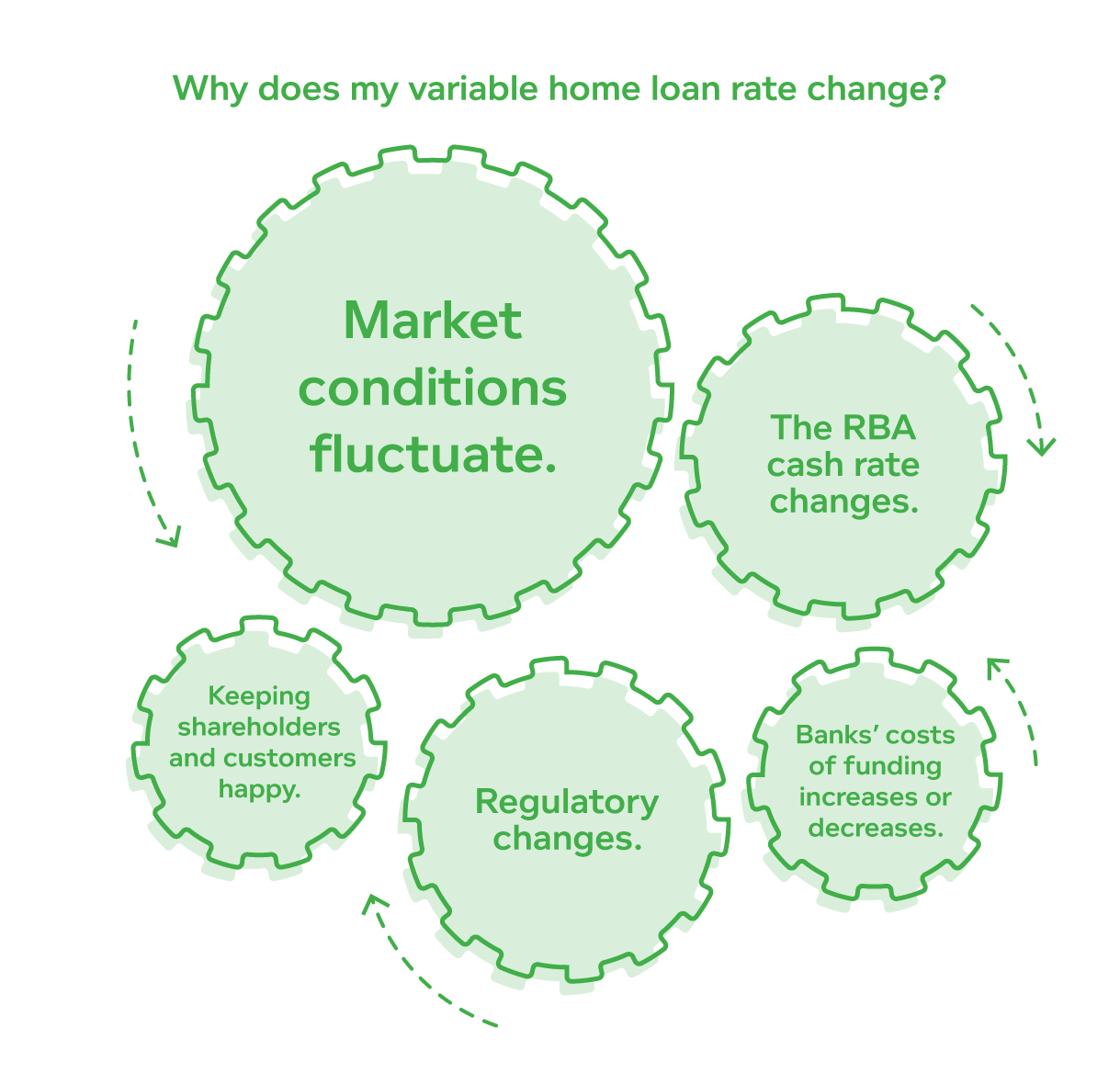

Why do variable rates change?

Here's everything that can cause a variable interest rate to rise (or fall).

August 13, 2018 • 5 min read

Variable interest rates, just as their name implies, are variable, or changeable. They can go up or down, at the lenders’ discretion. But why? The short answer: Changes in the market impact lenders’ decisions on how to set their home loan rates. And variable rates can fluctuate depending on these changes.

The longer explanation: There are several factors lenders consider when they decide on where to set their home loan rates, and whether they should raise, lower or maintain them. But what are these factors and how do they impact the change?

Factor 1: the Reserve Bank of Australia (RBA) changes the cash rate

The cash rate is just the interest rate the RBA charges on overnight loans to the commercial banks – CBA, ANZ, NAB, Westpac, Bendigo & Adelaide Bank, and the list goes on. There isn’t much more to it than that, but this rate affects a lot of other things in finance.

The RBA is in charge of reviewing and adjusting the cash rate every month (excluding January, because even they need a break). That’s right, once a month. But this doesn’t mean your home loan rates will rise or fall each month. The banks themselves are the other determining factor for a rate change. More on that later.

A cash rate is reviewed by examining the state of the Australian economy. When conducting their review, the RBA look at the cost of a selection of consumer goods and services, also known as the Consumer Price Index (CPI), if the price of these goods and services rises above the allowed 2-3%, the RBA may raise the cash rate to try and slow our spending. Likewise, if the price lowers more than 2-3%, the RBA may lower the official cash rate to try and encourage consumer spending. In doing this, the RBA are looking to try and slow the rate of inflation, maintain the stability of our currency and maintain employment in Australia. All very good things.

Factor 2: Banks need to cover costs

Why do interest rates change when the RBA hasn't changed the cash rate? The cash rate is only one factor lenders consider when determining interest rates. Another significant factor is the cost of funding.

Banks have diverse sources of funding, with most of it coming from deposits, and short and long-term wholesale debt (explained below). One way or another, every source of funding comes with a cost. In a nutshell, that’s how banks make money: they lend money at a higher interest rate than they borrow it.

Any changes in the composition of funding sources or the cost of these funds affect the interest rate they lend money at. Over the last few months, the banks have seen large increases in wholesale short-term borrowing costs, which is why, generally, interest rates have started to rise (more on this later).

Here is some more detail about the ways banks source money, so they can lend it to us:

- Wholesale debt

Wholesale debt is money the banks borrow at a lower cost (or “wholesale” cost), to then lend out to borrowers. They use this type of funding, so they can have the upfront cash ready to lend to customers. - ‘Residential mortgage backed security’ (RMBS)

RMBS is a pool of home loans owned by a bank, that are packaged together and sold as bonds to investors. Essentially, the investor is purchasing the profit from a group of home loans for an upfront fee. The bank pays the investor back with the profit from those loans. While this gives the bank more funds in the short term, it also gives them more debt in the long term because they need to pay the investors based on the performance of the loans. - Bank bill swap rate (BBSW)

The BBSW (yes, ‘W’ not ‘R’) is the fee banks charge when they lend money to other banks. It seems weird that banks would even do this, but it is a handy way for them to cover their day-to-day costs when they spend more than they make in a day (which can sometimes happen). The BBSW fee is represented by the interest rate, just like every other loan. - Deposits

Banks’ main source of money is from deposits. The money in your saving account is used to lend to someone else.

Factor 3: Regulations and financial crisis

Remember back to 2008 when the whole world was in a fluster because of this thing called the Global Financial Crisis? The United States housing market was experiencing a long period of growth and everyone expected this growth to continue. Because of this expectation, banks in the U.S. started giving out excessively risky loans to people and packaging them into RMBS bonds which they sold to investors. The more loans the banks gave out, the more money they borrowed so they could continue lending. As you may have guessed, housing prices in the U.S. fell; there were a bunch of people who had loans they couldn’t afford; and the banks owed a lot of money (which they didn’t have).

Why is this relevant to us you ask? Well, in response to this crisis, the Australian Prudential Regulation Authority (APRA) raised the capital requirements for Aussie banks. In other words, our banks needed a higher ratio of money in reserve for every dollar they lent. It was a safeguard in the event of another financial crisis.

Fast fact: Global reform measures, such as the Basel III framework, mean that by 2019 banks will have higher capital requirements. Meeting these requirements means home loan rates may need to increase.

Keeping everyone happy

It’s probably no secret that banks have a number of different stakeholders they need to try and keep happy, mainly, shareholders and customers. To keep shareholders happy a bank needs to have a high return on equity (ROE). ROE is the fancy term for the profit that the bank makes for every dollar the shareholders invest. Increasing rates can raise the banks’ returns and keep shareholders happy, however, this obviously upsets customers. Lowering rates keeps the customers happy but reduces the bank’s return and upsets shareholders (who could also be customers of that bank). And then there’s the consideration of growing their market share – can the lender set their rates strategically to get more new customers and/or keep their existing ones? It’s a tricky balancing act.

For example, some banks may go against the market trend and reduce their variable rate for new customers, despite the increase in their funding costs. While we can only speculate, it would seem other banks lower rates to increase their market share (get more new customers) while withstanding the pressure of increased costs. It's interesting to see what lenders do to maintain a competitive edge, and pays to do your research on a regular basis, especially if you're in a position to refinance.

The sword cuts both ways

The drawback of a variable interest rate is that it is liable to change, but on the plus side, the beauty of a variable interest rate is that it is liable to change! While it may not always land in your favour, your variable rate can decrease from its original amount. And it allows you to be more flexible if your situation changes – for example, you may want to make bigger repayments or sell your home. In the end, when considering a variable rate, you need to be aware that with the potential for your rate to drop, also comes the potential for your rate to rise. That’s just how the cookie crumbles.

Tiimely Own's rate rises (and falls)

At times, for any or all the factors above, banks will decide to increase their interest rates outside of the cash rate cycle by the RBA. It’s never an easy decision – there are a lot of stakeholders to consider. Ultimately, Tiimely Own home loan rates are reliant on the banks (and our funders) for the money it lends, so although we work hard to achieve the best outcome for our customers, we’re not immune when interest rate rises occur.

Get Tiimely Own's latest rates.

Show me