What Is a Building Inspection and Why Is It Important?

And do you need one? Read on to find out.

July 09, 2019 • 7 min read

So you’ve found your dream home and have your home loan sorted, but before you move on to settlement you may want to think about getting a building inspection. A building inspection will help pick up any defects, damage, or future issues that your potential new home may have. It could also help save you money by giving you leverage for negotiations on the purchase price!

We sat down with Andrew Skinner from Jim’s Building Inspections in SA to learn more about building inspections and why they are so important. Operating under the well-known brand of Jim’s Building Inspections, Andrew brings a depth of experience to his role as Regional Franchisor for South Australia. The appointment to his current role in 2012 was a culmination of more than 28 years of experience as a licensed builder, site supervisor and carpenter across the commercial and residential sectors of the Adelaide construction industry.

Andrew Skinner - Jim's Building Inspections

What is a building inspection?

So, what is a building inspection anyway? In short, a building inspection is a report completed before purchasing a property that summarises its current condition. Andrew explains, ‘it’s basically a condition report of the property detailing anything that may be of concern to a potential purchaser’.

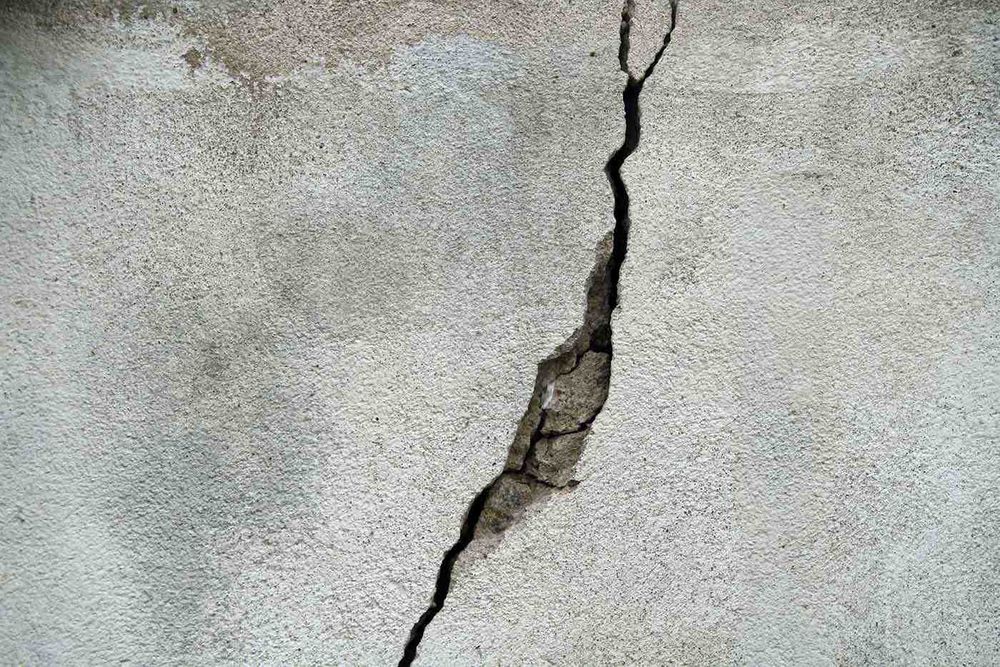

The process of a building inspection involves an inspector going through the property and looking for issues. ‘We’re looking for anything from movement, subsidence, cracks, operation of windows and doors’, explains Andrew. Basically, the inspector uses specialised equipment and goes through every part of the property that they can access, checking for anything that would concern a potential buyer. This could include problems like moisture, salt damp, termite damage, the condition of the roof and they can even include the compliance of the pool (if the property has one). Appliances, however, won’t be checked during the inspection, so things like the air conditioner or the gas stove won’t be covered in the report. A detailed explanation of what is and what isn’t included must be provided to you prior to the inspection taking place, this is called the Pre Inspection Agreement.

The time it takes to complete the inspection will obviously depend on the size of the property being checked. Andrew estimates that ‘it can take anywhere between 1 or 2 hours to conduct the inspection on site, and then a further 1-2 hours putting the report together’. But the only time you’ll need to set aside is around 10 minutes at the end of the on-site inspection, so the inspector can run through the results with you – not very much time at all! Or if you can’t make it to site you may prefer a phone call afterwards.

Why are they important?

For buyers, Andrew says that building inspections are important because they ensure ‘that an experienced, qualified inspector (assuming that you use the right company) has gone over the property and has picked up defects that an untrained eye is likely to miss. A building inspection will reduce the risk of unforeseen costs to the you after your purchase. And because of this, they can also make a good bargaining chip when negotiating the purchase price of the property. Andrew describes one example of this, ‘sometimes there's more negotiations to be made because someone walks into a property and says “oh, this is great. We'll extend ourselves to 'x' amount of dollars, but we don't have anything in reserve”. All of a sudden, we find out there's a $20,000 retaining wall that needs to be replaced, and so they go back to the negotiation table. The agent can then do an addendum to the contract and actually change their offer after the offer has been accepted. This stops the vendor from losing a sale and the purchaser to still go ahead and buy the home of their dreams.

On top of this, Australian building inspectors must act in accordance with Australian Standard 4349.1. ‘This standard lays out exactly what we need to inspect’, Andrew explains, ‘another key role to our building inspections is making the buyer aware of the maintenance they may be facing in the future’.

But it’s not just buyers who can benefit from a building inspection, there are some positives for sellers as well. If you’re selling a property you can get something called a Vendor Report which will uncover items that may be issues for potential buyers. This way as a vendor you can be ‘armed with all the knowledge and know what may be found when a buyer goes to get their own building inspection. From here you can have repairs completed or have a thorough response ready explains Andrew. By getting repairs done early you can get the best purchase price for your property.

Who should get a building inspection?

As Andrew says, ‘it just makes good sense to feel safe about what you’re doing and the purchase you’re about to make’. Which is why he says that anyone who is buying a house should get a building inspection. Whether you are buying a brand new house or an older home, it is a good idea to get a picture of the existing and potential issues you may have with the property.

Your building inspection can be organised by different people depending on where you live in Australia. In Sydney it is very common for the conveyancer to organise the building inspection, whereas in Adelaide it is mostly left to the buyer to organise an inspection. So it’s a good idea to ask questions and make sure that one gets organised. Andrew adds, you have good people in your corner when you are purchasing a property e.g. conveyancers, building inspectors so use their knowledge pool as they are industry professionals.

What are the costs involved?

As with any service, there is a cost involved with getting a building inspection done. Andrew explains that the cost of a building inspection will depend on the size of the property being inspected. The price, he says, can be ‘anywhere from $385 for a small unit, up to $660 or $770 for a larger place’, and this cost is usually covered by the buyer. But the good news is this cost includes a pest inspection as well, which is also a good idea when buying a property.

If you’re worried about extra costs sneaking in, you can rest at ease because usually the prices for inspections are fixed. As Andrew explains, the only additional costs will be for any repairs or additional inspections from other services (plumbers, electricians etc) that need to be done as a result of what is found from the inspection. Building inspections are non-invasive and non-destructive, so there won’t be any additional repair costs from the inspection itself.

What happens if they find something wrong?

Andrew explains that building inspections aren’t about talking people out of buying a property, but more about making them fully aware of what they are getting into. So when a defect is found it often means further negotiations are needed rather than someone backing out of buying the property (although there are sometimes exceptions to this rule). The purchase price of the property can be dropped to accommodate the cost of the repairs, (or part thereof) or the defects can be corrected before the purchase is completed.

Do you need a licence to be a building inspector?

Surprisingly, whether a building inspector needs a licence to operate differs from state to state. As Andrew explains in some states, no licence is required to be a building inspector, ‘honestly, a baker would legally be allowed to go and do a building inspection’, he says. Some companies (like Jim’s Building Inspections) however, do still require some level of qualification for their employees. ‘Our guys have got to have minimum 5 year’s experience in the building industry along with other qualifications, whether it be engineer, architect, or licenced building’ he goes on. With this is mind, it will pay to do your research when looking for a building inspector. Make sure you find one with experience and appropriate qualifications (even if they aren’t required), to ensure you are getting a thorough job done. If time permits Andrew recommends searching review for providers also. You don’t want to fork over money only to find something was missed in the inspection!

Are there other things I need to get checked?

When it comes to other tests and checks, Andrew recommends having a good conveyancer, ‘a conveyancer will help you negotiate your way through all of your form 1’s, your easements etc. You need to understand all of that’. You can read all about conveyancing in our home loan guide article. And for extra peace of mind, you can also get pest inspections, asbestos inspections and Methamphetamine testing done.

So, do I need a building inspection?

Ultimately, the choice is yours when it comes to getting an inspection done. They can be handy to give you an idea of any future problems you may have with the property you’re looking to buy. And they can help point out any major defects that may need immediate attention. Going with an experienced and qualified inspector will ensure there are no nasty surprises waiting for you after your cooling off period.