Interest Rates 101: What You Need to Know

What makes up an interest rate? What's the difference between variable or fixed? Here we break down the jargon so you can get the facts fast.

August 21, 2018 • 6 min read

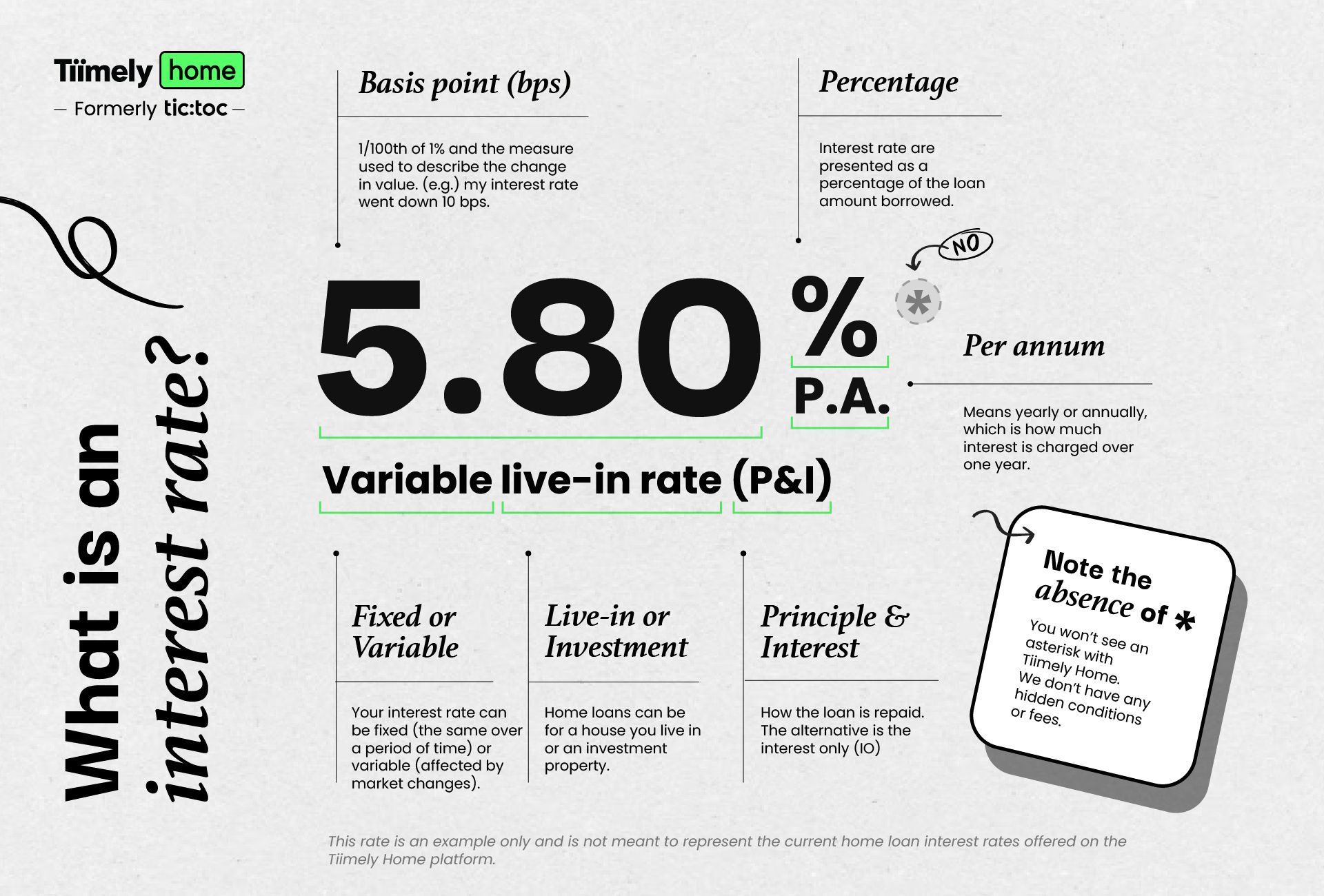

What is an interest rate?

Put simply, an interest rate is the fee that banks charge you for borrowing money. It is represented as the percentage of your total loan amount that you will be paying (e.g. 5.80% of your loan amount). By paying interest on your loan you are paying the fee that the bank is charging for lending you the money. Interest rates on savings accounts and term deposits represent the fee that the bank is paying you for allowing them to use your money (by lending it to other people).

Two types of interest

There are two main types of interest payments: fixed and variable. Both have benefits and drawbacks depending on your situation.

Fixed

A fixed interest rate is a rate that is secured and locked in for a certain period (generally 1-5 years). During this time the interest rate doesn’t move (up or down) regardless of what the market’s going interest rates are; or what the Reserve Bank of Australia (RBA) sets as the official cash rate.

Why fix your rate?

- You’re Type A, and like the certainty of knowing your repayment amount will stay the same,

- You’re any other Type of person who also likes this certainty,

- You’re a fortune teller who knows rates will rise soon (fixing to secure a lower rate will save you money),

- You don’t plan on making lots of extra repayments to reduce your loan amount (additional repayments are limited on fixed loans), or

- You don’t plan on switching loans any time soon (fixed loans have break costs).

If you’d like more information about the pros and cons of fixing your rate, check out this article, Is now the time to fix my home loan rate?

Variable

A variable interest rate changes depending on the market and the cash rate set by the RBA. It can change at any time and can either increase or decrease - find out more about the RBA and interest rates.

Why choose variable?

- You’re a go-with-the-flow type of person, who wants a flexible, no fuss home loan,

- You’re any other type of person, who also wants a flexible, no fuss home loan,

- You’re a fortune teller who knows rates will go down soon (because your loan rate will go down too, which will save you money),

- You want to pay down your loan quickly by making extra repayments, or

- You think your situation might change soon (e.g. plans to renovate or buy a new home), which would mean changing your home loan.

As you’ve probably started to work out, each is good in specific circumstances. Because a fixed rate isn’t influenced by current rates or the RBA cash rate, it is good for when you want to lock down a low interest rate, want certainty of repayments or when you want protection against interest rate rises. On the flip side, if you’re after loan flexibility and ability to make additional repayments a variable rate is the option for you. Also, because variable rates are inclined to change, they are good for when current rates are high and likely to drop. However, nothing is ever a guarantee and just because rates are likely/expected to move in one direction, it doesn’t always mean they will. You can read more in our article about how banks and lenders set their rates.

Interest and comparison rates

So, if an interest rate represents the fee you’re paying to borrow money, what is a comparison rate? It’s a handy little thing that helps you to see the true cost of your loan. Comparison rates take into consideration the additional fees and costs associated with a loan and shows this as an adjusted interest rate. You can read our Interest rate vs comparison rate article if you want more detail.

How is interest calculated?

There are two types of interest calculations: simple and compound. Simple interest is calculated as a percentage of an initial amount of money which is invested. This calculation method is used on term deposits. Compound interest is calculated on the entire amount of money, including previous interest payments. Essentially this means you are accumulating interest on your interest. This is the method used on savings accounts, regular bank accounts, as well as credit cards, home loans and personal loans.

What’s a basis point?

If you’ve been looking into interest rates you may have heard of something called a basis point. A basis point is just a fancy name for a unit of measurement commonly used for interest rates and other percentages in the financial sector. Basis points are used to calculate changes in rates and to remove ambiguity when discussing percentage increases or decreases.

It is much clearer to say that a rate of 3.50% will increase by 100 basis points rather than saying it will increase by 1.00%. Saying an interest rate will increase by 1.00% could mean either, that you should add 1.00% to 3.50% to get 4.50% or you should multiply 3.50% by 1.00% to get 3.535%. Because of this possibility for confusion, the basis point system is used. A basis point is the equivalent of 1/100th of a percent (0.01% or 0.0001).

A change of 1% is equal to 100 bps, meaning that if a rate has increased by 100 bps it has moved from 3.50% to 4.50%.

Why do we have interest rates anyway?

Interest exists as an incentive for banks to lend money (it’s a risky business after all). Because interest is the fee you pay banks to get them to lend you money, it increases as the risk in lending increases. This gives the banks more incentive to consider giving you the loan. It’s also one of the ways that lenders make a profit, which may sound greedy and evil, but profit enables banks to continue lending out money – they do have bills to pay as well.

So, we only want low interest rates, right?

When it comes to your home loan, yes. The more holistic answer however is, not necessarily. As with most things, there are pros and cons of interest rates being either low or high, and they impact you in different ways.

Low interest rates

High interest rates

Want the lowdown on Tiimely Own’s interest rates? Take a look.