5 Must-Have Apps for Managing Your Finances

We've compiled the 5 best money and finance apps to help you keep your eye on the prize - your hard-earned dollars. Check out our favourite apps to make the most of your cash.

August 20, 2019 • Last updated November 16, 2023 • 5 min read

It can be hard to keep an eye on your finances – in fact, the more you earn, the messier it can get! So how can you manage your spending, make time to invest and save, track your IOUs between friends, and stay on top of bills? Well, there’s an app for that. In fact, there are plenty of apps, but we've compiled the 5 best money and finance apps to help you keep your eye on the prize - your hard-earned dollars.

Work smarter, not harder

Allan Mogensen, famous American industrial engineer.

In this case, save smarter, not harder (but it will never hurt to do both).

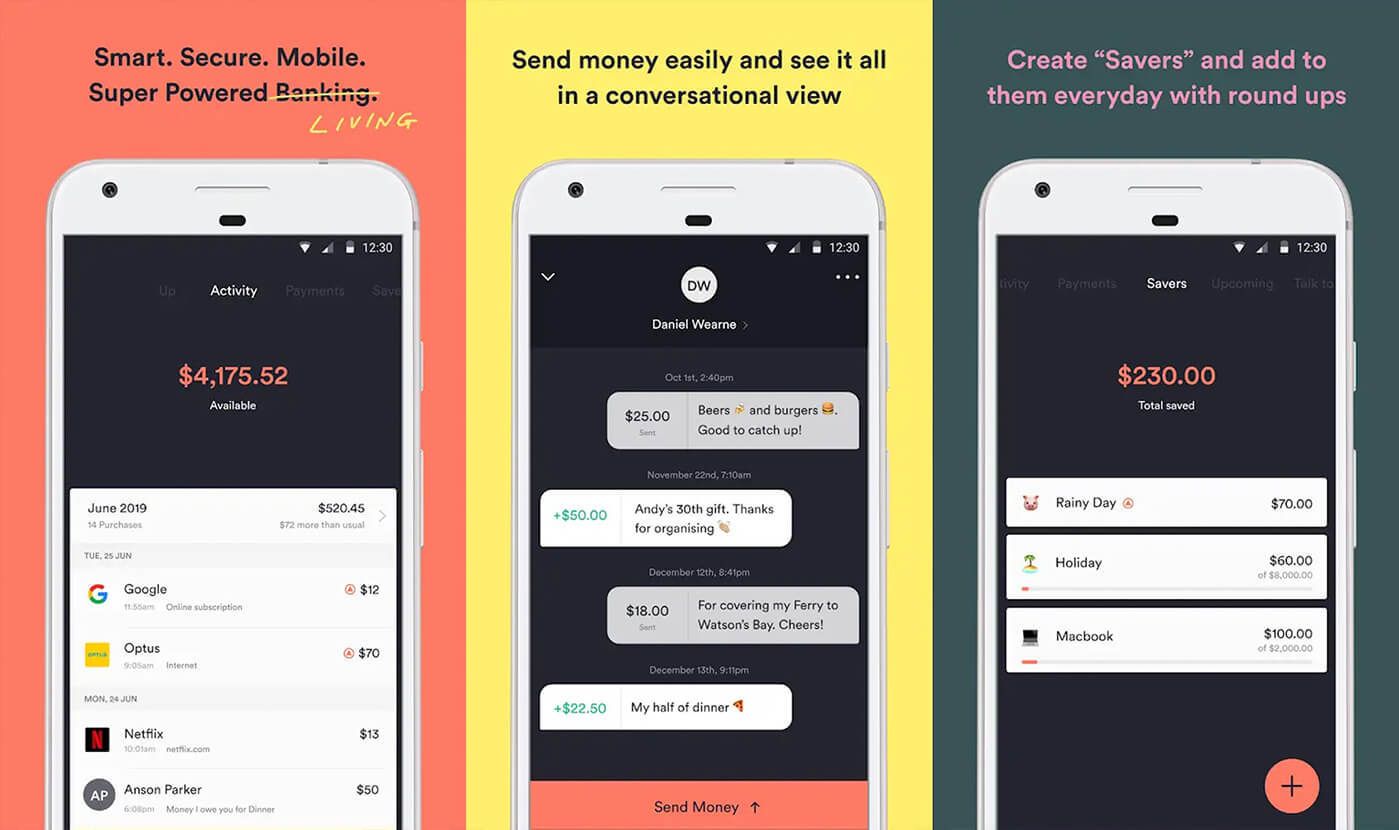

Up

The super-cool bank of the future is here! Up is turning the industry on its head, creating a simple, mobile-first everyday banking experience. Their special sauce? Tech-led banking, instead of bank-led tech. And, they’ve got a killer fluoro orange debit card. Like us, they’ve partnered with Bendigo Bank to make their fintech dream a reality (a reality for 725,000 users). Since they’re fresh off the block and not bogged down with legacy banking systems, they have some cool tech tricks up their sleeves. And did we mention their fluoro orange debit card?

Best bits:

- no fees(!) — no monthly fees, no overseas purchase fees and unlimited withdrawals.

- Fluoro orange debit card.

- Merchant ID and smarter expense categorisation – have more clarity over your finances.

- Automatic round-ups, to help you save.

- Osko payments support – send and receive money in near real-time.

- Their debit card is fluoro orange.

- More features coming UP soon.

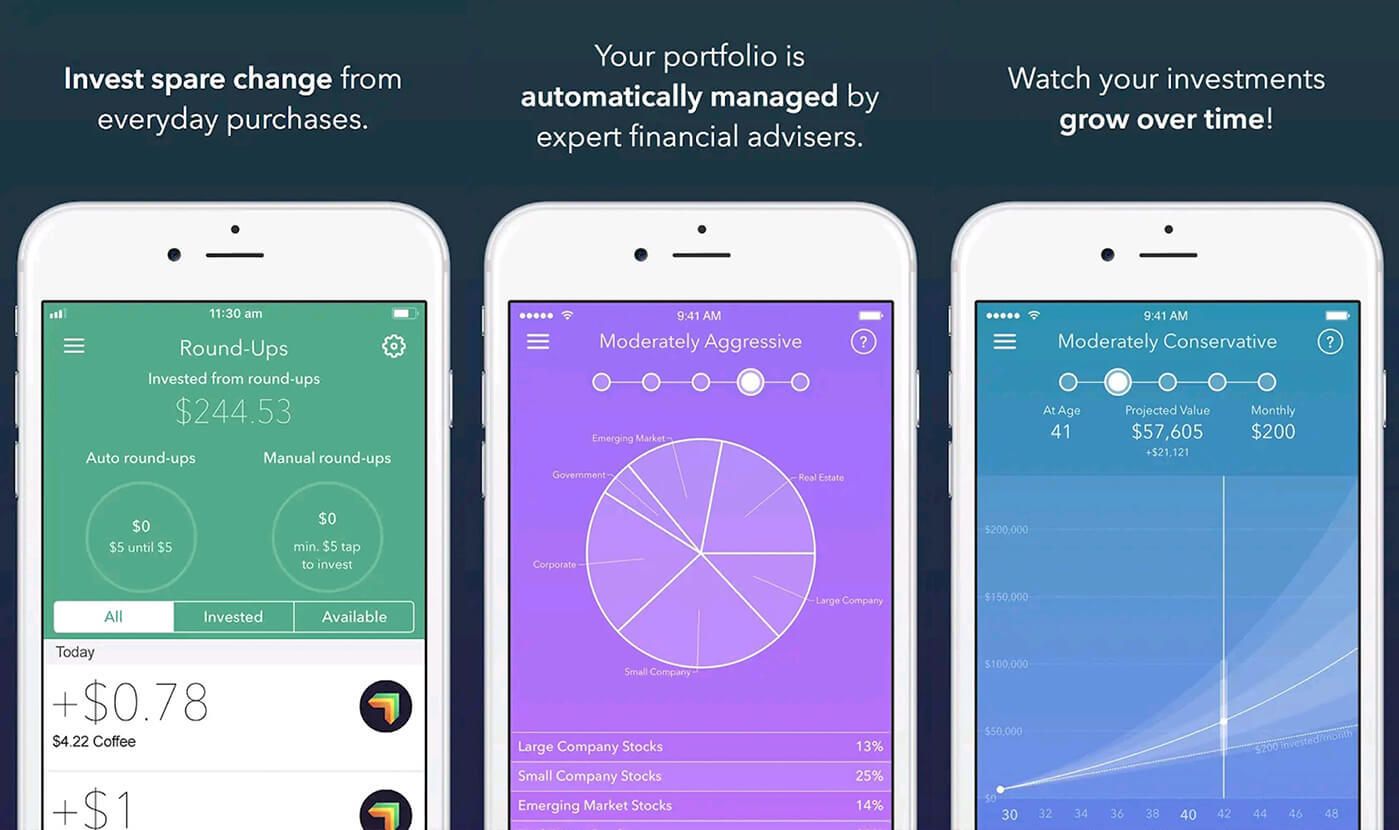

Raiz

Raiz (originally called "Acorns") was built on the premise of a squirrel storing away acorns for the Winter. Similarly, this app helps you to store away money (and invest it, too). By rounding up your everyday purchases, Raiz helps you to squirrel away those extra funds and automatically invests them into a diversified portfolio of your choice. You can even set recurring deposits to supercharge your investments.

Raiz is a great app for those who have trouble saving or for those looking to dip their toes into the world of investing.

Best bits:

- Great introduction to investing.

- Pick your portfolio - from conservative to aggressive.

- Sustainable portfolio option.

- Your investments are automatically rebalanced and diversified to reduce risk.

- Bank-level security.

- Deposit or withdraw at any time.

- Easy, behind-the-scenes saving with Round-Ups.

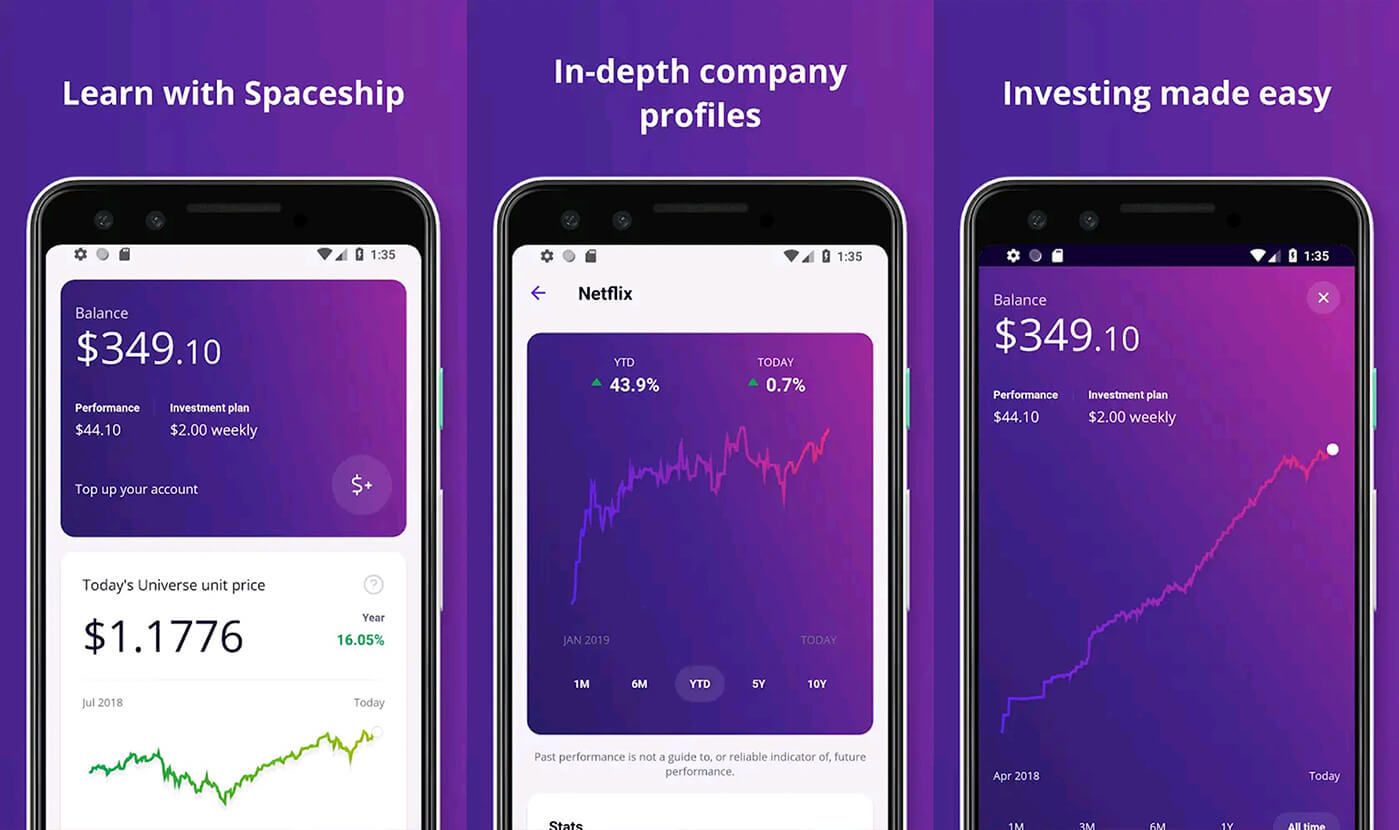

Spaceship

Mobile investment for future-focused tech companies, which “invests in where the world is going, not where it’s been”. Spaceship left the launchpad in 2018 and has continued its fast, upward ascent, managing more than 39,000 users and over $27 million in funds.

Similar in function to Raiz, Spaceship is best for those who want to take it slow, but also have an appetite for higher-risk, higher-reward options. You’ll learn the fundamentals of trading and investing as you go.

Best bits:

- Invest as little as you’d like with no minimum amount.

- Affordable investing: fee-free for balances under $5000.

- Choose from 2 portfolio options.

- Spaceship Index Portfolio – 200 companies with large market caps. 100 ASX listed companies and 100 companies on overseas exchanges.

- Spaceship Universe Portfolio – 100 listed companies with a focus on high-growth technology stocks.

- In-depth company profiles.

- Learn as you go – Spaceship will give you articles and insights to hone your confidence as an investor.

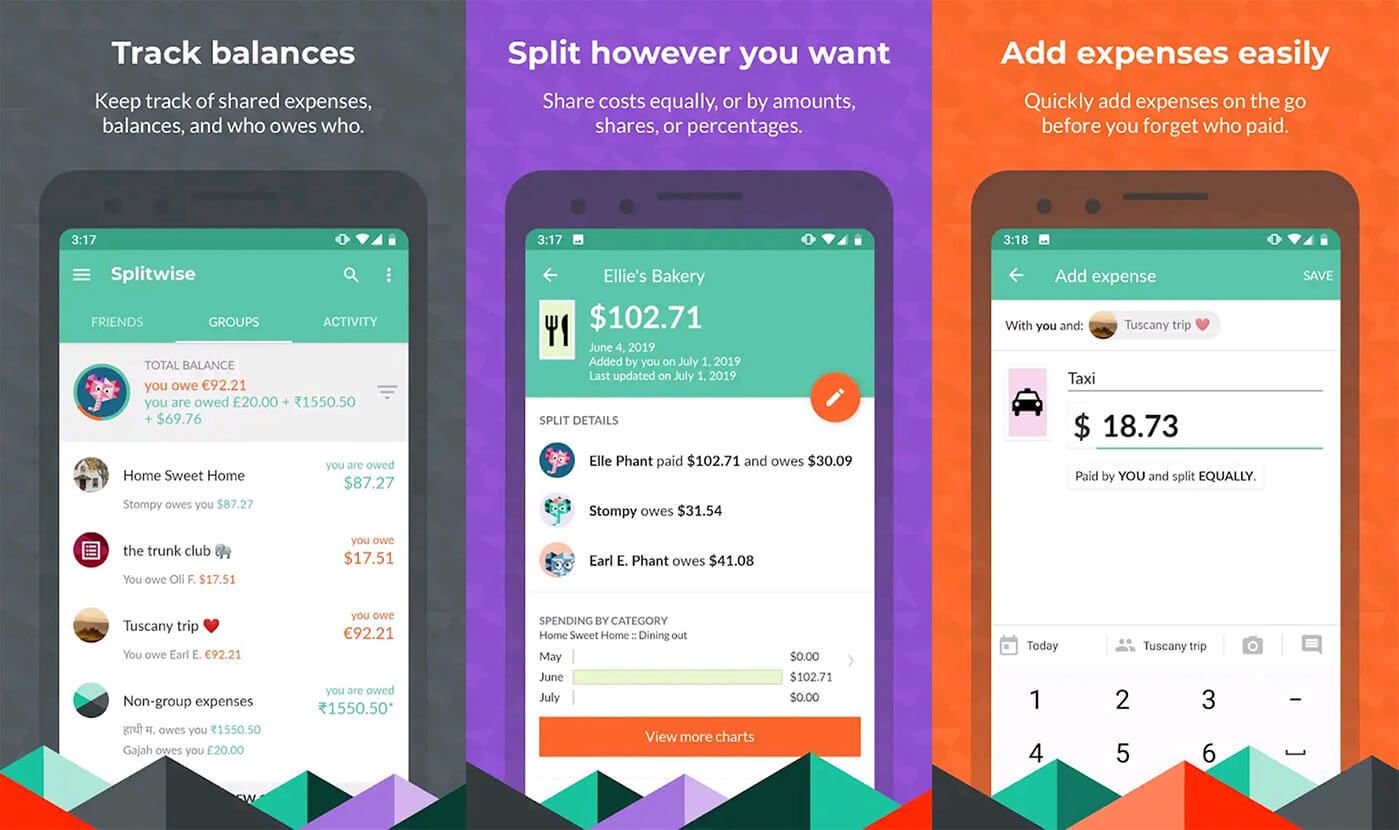

Splitwise

Splitwise is perfect for splitting expenses between two or more people. Whether you need to keep track of household bills with flat mates, keep a running tab with your travel companions, or if you need to track expenses between you and your significant other, Splitwise does it easy-peasy.

Enter how much you are owed and by whom, and Splitwise will do the rest. It tracks all owed bills across a group and automatically balances them, reducing unnecessary back-and-forth transactions. No one will ever forget to pay you back again.

Best bits:

- Quickly add and split bills between multiple people.

- Attach photos to expenses (for storing your receipts).

- Manage payments across multiple groups of individuals.

- Add recurring expenses, like utilities or rent.

- Great for tracking who owes what.

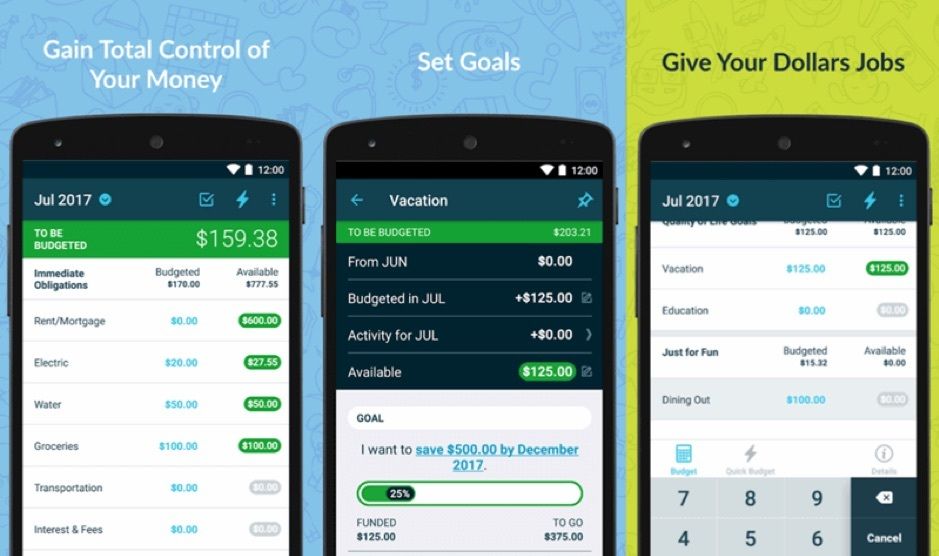

You Need a Budget

Or YNAB, for short, is a budgeting app that primarily focuses on paying down existing debts. Follow their four rules and you'll be paying off that pesky credit card in no time. Enter your income and assign every dollar to a budget category, then track your expenses and try not to break your budget! By being more aware of your money and how available it is for spending, you can be more conscious when making discretionary purchases.

Best bits:

- Effective tools to help pay down debt.

- Create and track personal budgeting goals.

- Insights and analysis of spendings and savings.

- Every dollar is budgeted.

- Sync with your financial institution.

Available for Android and iOS.

Learn more about saving: