Comparing Interest-Only and Principal & Interest Home Loans

Both types will help you borrow money, but the way you repay them are slightly different — with some potentially big implications.

April 26, 2022 • Last updated October 24, 2023 • 6 min read

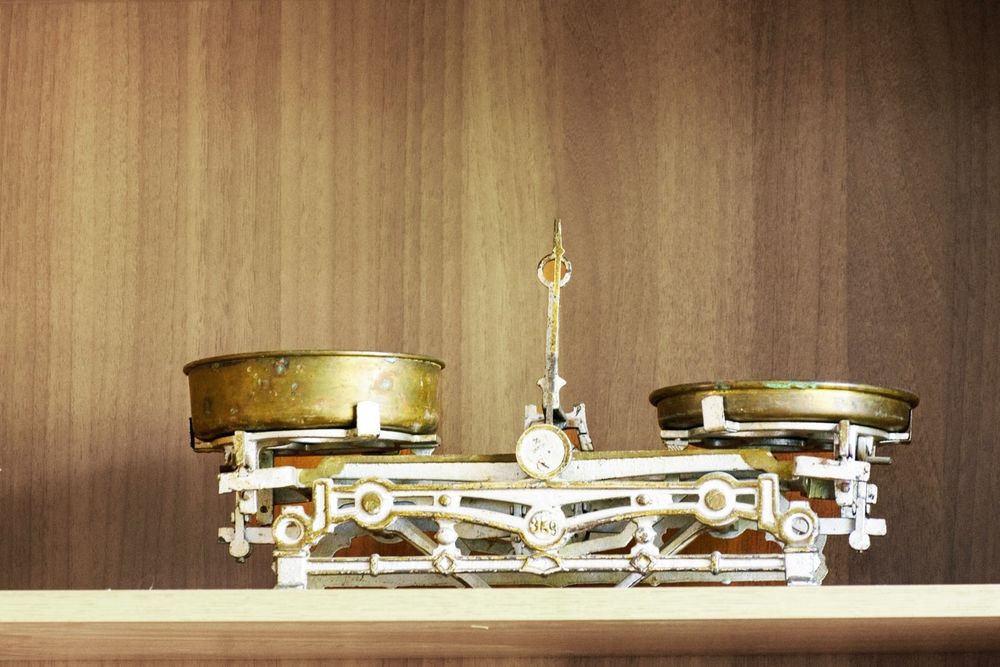

There are stacks of things to weigh up when picking a home loan. Do you want a fixed or variable interest rate? What loan amount are you looking for? Do you want extra features (like linking an offset account to your loan)?

But out of all the things you’re probably tossing up, this is likely to be the most important: should you pick an interest-only or principal and interest home loan?

These loan options come with important pros and cons to consider and can make a big difference in how much you pay over the lifetime of your loan. So, let’s run you through the difference between an interest-only loan and a principal and interest loan, and what you need to know to make an informed decision.

What are principal and interest (P&I) loans?

Before we go any further, let’s give you a quick refresher on how home loans work. When you take out a loan, you’re borrowing a specific amount of money from the lender (known as the principal). Over time, interest will accrue on your loan which you’ll have to pay off as well.

So, a principal and interest home loan means you’re paying back both the original loan amount and any interest you’ve accrued at the same time.

While this does mean your monthly repayments will be higher, a P&I loan allows you to build equity faster and lower the amount of interest you need to pay over the long term.

The pros of P&I loans

In a nutshell, some of the benefits of a P&I loan can include:

- You’ll score lower interest rates as lenders see you as a lower-risk borrower.

- You’ll pay less interest over the life of your loan as you’re chipping away at your original loan amount from day one.

- You’ll build equity in your property faster, which can speed up your journey to securing your next home or investment property.

The cons of P&I loans

On the flip side, some of the drawbacks of a P&I loan include:

- The biggest con with a P&I loan is that you’ll have higher monthly repayments, which can be tricky to cover if you don’t budget ahead of time or have a strong cash flow plan.

What are interest-only home loans?

As the name suggests, an interest-only home loan involves only making repayments on the interest portion of your loan (not the original loan amount). Typically, you’ll only be able to secure an interest-only loan for a set period of time (usually a fixed term of one to five years).

After your interest-only period ends, you’ll switch to a P&I loan and start paying down both your original loan amount and any interest you’ve accrued.

The pros of interest-only loans

The main benefits of choosing an interest-only loan include:

- You’ll score lower repayments during your interest-only period (compared to a P&I loan).

- You can navigate periods of financial hardship without having to default on your loan by switching to interest-only payments.

- You may be able to access tax benefits and claim higher tax deductions if you’re an investor taking out an interest-only loan.

The cons of interest-only loans

On the other hand, some of the drawbacks of interest-only loans can include:

- You’ll likely be charged a higher interest rate as you’re seen as a higher risk borrower.

- You’ll pay more interest over the lifetime of your loan as your original loan amount isn’t being paid down during your interest-only period.

- Your repayments will increase once you switch to a P&I loan, which may make your loan unaffordable if you haven’t budgeted for this repayment increase.

- You’re not building equity in your property during your interest-only loan period.

Need a hand figuring out what your repayments will cost? Check out our free online repayments calculator to compare your loan options.

Commonly asked questions about P&I vs interest-only loans

Is it better to pay interest-only or principal and interest?

It really depends on your financial situation. If you need to keep your repayments low in the short term and are willing to accept paying more interest over the life of your loan, an interest-only loan can help you get into the market.

However, a principal and interest loan is a smarter option if you’re looking to save on interest over the lifetime of your loan. Plus, you’ll be able to build equity with a P&I loan faster and access a lower interest rate, too.

What interest rates can you expect with a P&I loan?

The interest rate you’ll expect to pay depends on whether you’re planning to live in your property or rent it out.

How long can you have an interest-only loan?

In most cases, interest-only loans have a lifespan of one to five years if you’re an owner-occupier. However, if you’re taking out an investment property loan, this interest-only loan term might be longer (depending on which lender you pick).

What happens at the end of an interest-only loan?

Once your interest-only period ends, you’ll be moved to a principal and interest loan. That means your repayments will increase as you’re now paying off both your original loan amount and the interest your loan has accrued.

This can be a good time to scout out the market and find a more competitive P&I loan product. If you don’t choose to refinance to a new loan, you’ll likely switch to your lender’s default P&I variable loan product.

Can you pay the principal on an interest-only loan?

Unfortunately, no. With an interest-only loan, you’re only able to pay off the interest on your loan (not the principal amount). This means the amount you’ve borrowed doesn’t reduce and you’ll effectively be treading water until your loan switches to a P&I loan.

The bottom line - what’s the difference between a P&I and an interest-only loan?

The big difference between an IO and P&I loan is the size of your repayments and how quickly you make a dent in repaying your original loan amount.

Ultimately, the loan option you pick needs to align with your financial situation and property goals. If you’re tight on cash and want to keep your repayments as low as possible, an interest-only loan can help you score affordable repayments for a set period of time.

However, if building an investment property portfolio is a big goal, choosing a P&I loan can help you build equity sooner (which can help speed up your next property purchase).

By understanding the pros and cons of both interest-only and principal and interest loans, you can make an informed decision about which loan option is right for you.

Here at Tiimely Home, we offer online home loans that can help you secure a loan on your timeline. Want to talk to a home loan expert about your options? Get in touch with our team at Tiimely HQ to see which type of loan might be right for you.