The simpler digital home loan

We made a home loan with everything you need and nothing more.

Enjoy fast assessment^, a seamless digital application and Livechat with real humans on the other end.

Variable

Tiimely own

5.29%p.a.Interest rate

5.30%p.a.Comparison rate

- No hidden fees

- Free online redraw on any additional repayments

- Unlimited additional repayments

- Up to 30 years loan term

Tiimely own

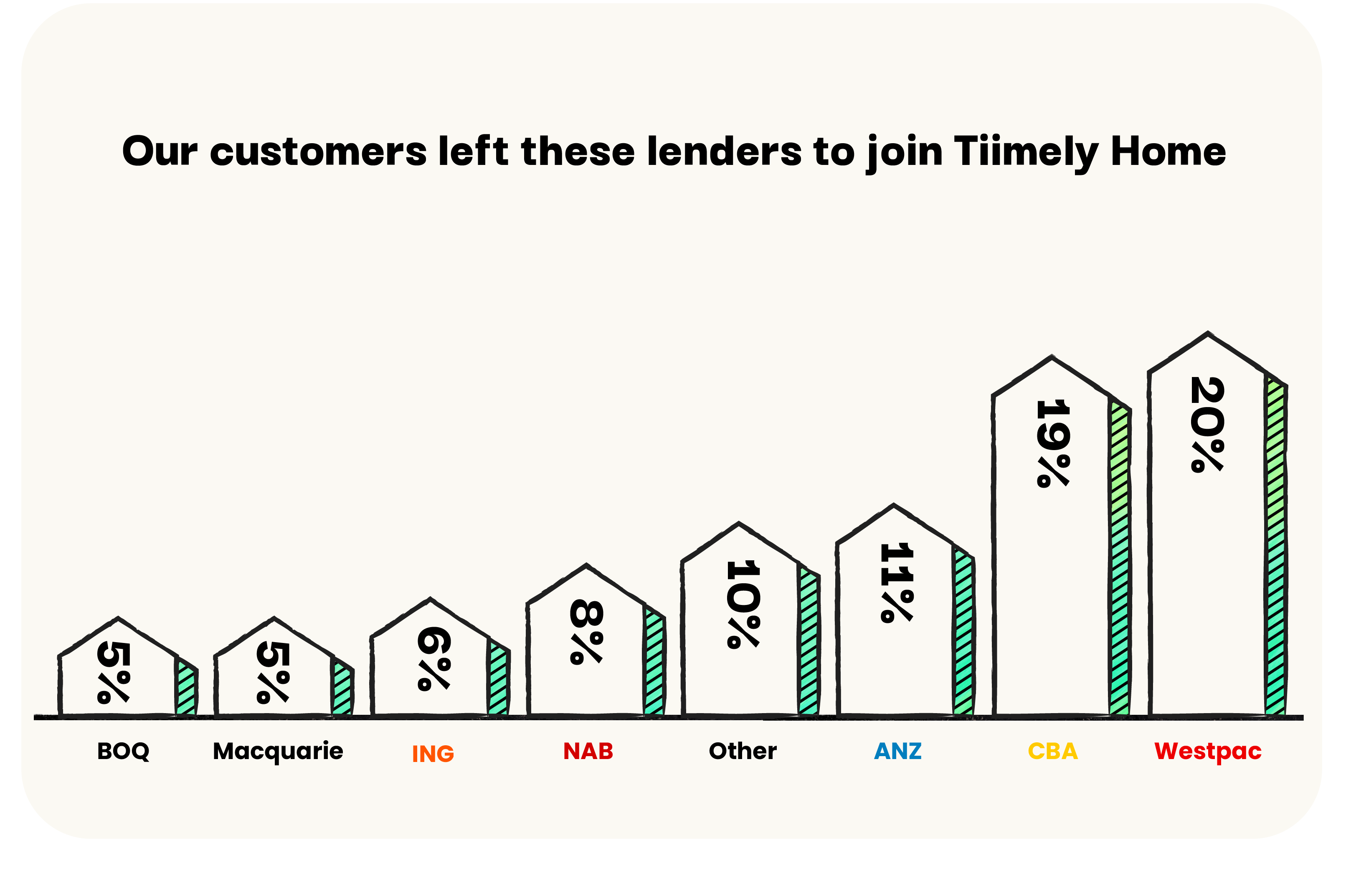

Our customers left these lenders for a Tiimely Own home loan

The graph to the right shows the proportions of lenders that our customers have refinanced from between Jan 1st, 2025, to April 1st, 2025. We use actual encumbrance data in these calculations. This graph is updated quarterly and was last updated on April 1st, 2025.

Here's why they switched

Fast settlement

Enjoy low rates, faster

Get approved faster for your Tiimely Own home loan. Our record for assessing and approving a home loan - with a contract – is less than 58 minutes from the time of application.

Tiimely own

Others just can't compete

We’ve built a better way to get a home loan. Our tech cuts time and cost from the process, so we can pass savings onto our customers. We keep our rates low, with no sneaky ‘catch’.

100% offset

Features you need, at a better rate

Get big-bank quality products with lower rates. Tiimely Own home loans have a 100% offset facility (even on fixed rates) or fee-free redraw.

Tiimely own

No hidden fees

Our fees are simple and transparent, so you'll always know what to expect. $0 Upfront fees, $0 Monthly Fees (excludes offset), $0 Application Fee, $0 Annual Fees.

Refinance your home today

With interest rates from

Variable

Tiimely own

5.29%p.a.Interest rate

5.30%p.a.Comparison rate

- No hidden fees

- Free online redraw on any additional repayments

- Up to 30 years loan term

Fixed 2 years

Tiimely own

5.29%p.a.Interest rate

5.30%p.a.Comparison rate

- No hidden fees

- Free online redraw on any additional repayments

- Up to 30 years loan term

There's more to love than just low rates

Our award-winning home loans are packed with all the essential features.

Secure, bank-backed offset

We’ve partnered with one of Australia’s biggest banks to give you a 100% offset facility that’s government-guaranteed.

Unlimited extra repayments

Get unlimited extra repayments for variable loans and up to $20,000 per year for fixed home loans.

Refinance & purchase

Whether you're looking for your first home, or want to refinance we have a home loan that will suit you.

Fixed-rate with offset

Unlike most other lenders, we offer a 100% offset facility for both our fixed and variable home loans, and you can link up to six offset accounts to your loan, so you can save on interest.

Free redraws

Make extra payments on your loan and reduce your interest, then easily access funds at a later date if you need cash.

Same low rate with a 10% deposit

With Lenders' Mortgage Insurance (LMI), you can borrow up to 90% and get the same rate, no matter your LVR. Get's you into your home faster.

Real customers, real savings

See what satisfied Tiimely Home customers say about us on Trustpilot.com

Tiimely own

The different kinds of fees

Government fees and charges

No matter what home loan is right for you, be aware of the government fees and charges that may apply during the process.

Talk to a local home loan expert

Get in touch, 7 days a week

We pride ourselves on our service. 90% of customer calls are answered within 20 seconds by our Australian-based team.

HUNGRY FOR NUMBERS?

We have calculators

Don't miss out on savings, apply in minutes

Apply online

It takes around 15 mins to apply. You'll get a decision in minutes or ASAP if we need a bit more info.

Break up with your lender

We'll take care of the paperwork and submit discharge forms to your lender.

Happy settlement day

We'll pay out your existing loan and set up your new accounts. Enjoy your savings.

Have questions? We have answers

What It Means to Be Backed by a Bank

Is Tiimely Home a bank?

No, we’re not a bank. But we’re backed by a trusted bank.

So what does that mean?

Tiimely Home has the backing of Bendigo and Adelaide Bank; they fund our home loans, provide our offset facility and importantly, giving our customers the protections a bank has in the unlikely event of a finance crisis. Read our guide on the Financial Claims Scheme (FCS) and why it's important that our offset facility is covered under the FCS for up to $250,000.

Our agreement with them to fund our Tiimely Own home loans means that when you get a Tiimely Own home loan, any funds we loan you come from Bendigo and Adelaide Bank.

Our proprietary tech that powers our application process, is so efficient at assessing customers for a home loan, that it means we can offer customers bank-grade products but with low rates and no hidden fees.

Bendigo and Adelaide Bank has been our partner since our early days and continue to be an important shareholder and invested in our future.

Why does Tiimely Home need a bank partner?

Partnering with a bank enables us to:

- reduce our overhead costs and offer lower interest rates

- focus on tech innovation for the home loans industry

- combine the best features of a bank (like offering an offset facility) with the best features of a Fintech (100% online application).

Low Rates, No Surprises: Here’s How We Do It

There is no catch, we just have a simpler, better way for customers to get a home loan.

Our Tiimely Home application is different to traditional applications. It’s not a manual form that you fill out digitally, but a live application that assesses your information and eligibility in real time.

It’s because of this efficiency in our process that we’re able to offer some of the best interest rates in the market.

Can I Apply For A Tiimely Own Home Loan?

You can easily find out by checking against our eligibility criteria. These consider a range of factors including:

- Property: value, location, and type

- Your contributions (deposit or equity amount)

- Employment: current and previous history, and type

- Identity: forms of government ID, and citizenship