Lock-in and relax for 2 years with $2000 cashback

Secure immediate savings on a low fixed rate. Available with 100% offset and as little as a 10% deposit.

Fixed 2 years

Tiimely own

Owner-occupied • Principal & interest

5.29%p.a.Interest rate

5.30%p.a.Comparison rate

- 5.29% roll-to rate after 2 years

- No hidden fees

- Free online redraw on any additional repayments

- $20,000 additional repayments limit per year

- 20% deposit required

- Up to 30 years loan term

Please note if you add an offset account, your comparison rate will change.

Refinance to get the savings sooner.

Everyone’s got an eye on rates, but timing the market is never easy. A competitive 2-year fixed rate gives you certainty upfront — and the $2,000 cashback can boost your return from day one. T&C’s and eligibility criteria apply (see below).

There's more to love than just low rates

Our award-winning home loans are packed with all the essential features.

Secure, bank-backed offset

We’ve partnered with one of Australia’s biggest banks to give you a 100% offset account that’s government-guaranteed.

Unlimited extra repayments

Get unlimited extra repayments for variable loans and up to $20,000 per year for fixed home loans.

No hidden fees

Our fees are simple and transparent, so you'll always know what to expect. $0 Upfront fees, $0 Monthly Fees (excludes offset), $0 Application Fee, $0 Annual Fees.

Fixed-rate with offset

Unlike most other lenders, we offer a 100% offset account for both our fixed and variable home loans so you can save on interest.

Free redraws

Make extra payments on your loan and reduce your interest, then easily access funds at a later date if you need cash.

Same low rate with a 10% deposit

With Lenders' Mortgage Insurance (LMI), you can borrow up to 90% and get the same rate, no matter your LVR. Don't wait years for a discount.

Tiimely own

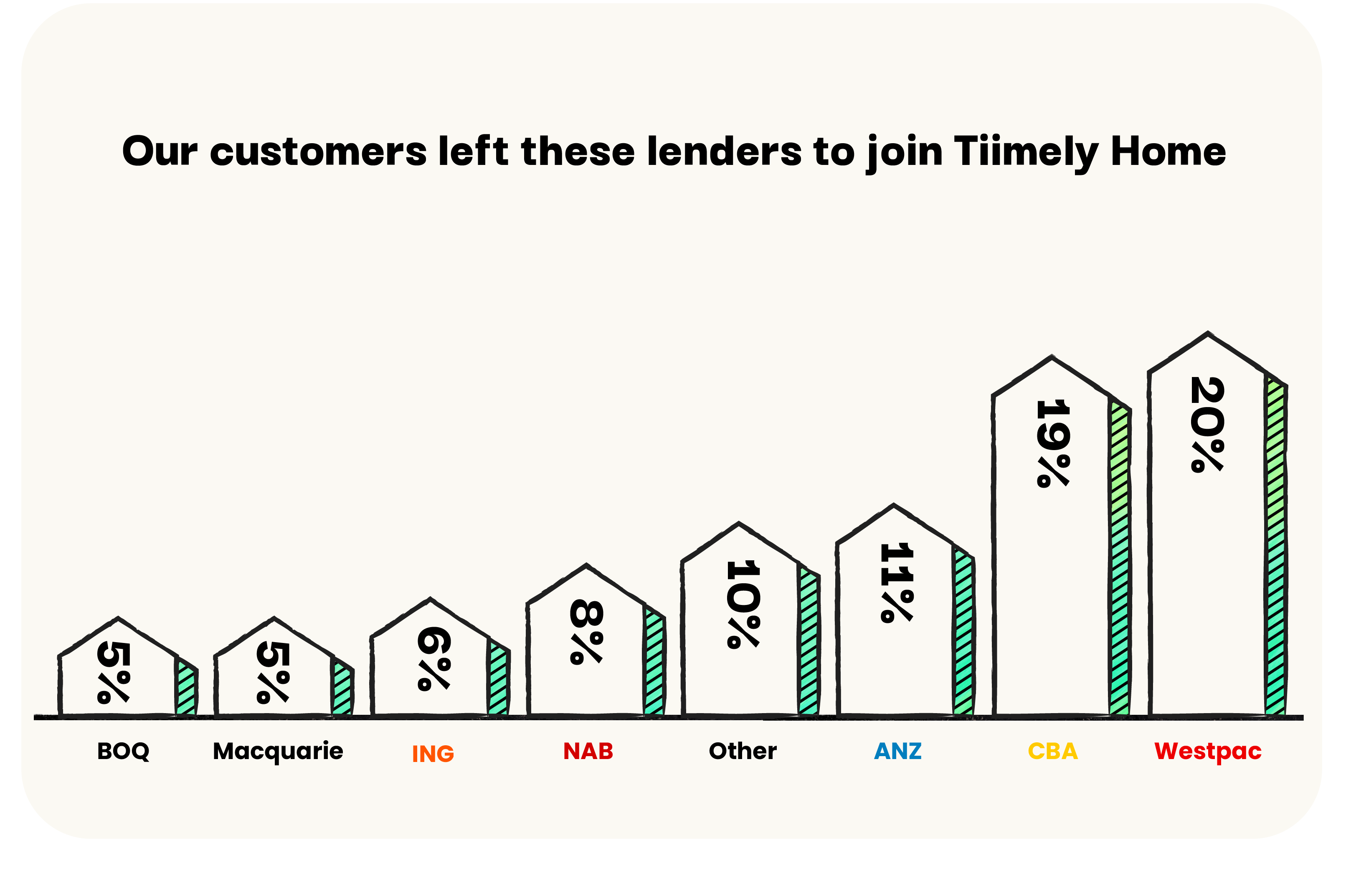

Our customers left these lenders for a Tiimely Own home loan

The graph to the right shows the proportions of lenders that our customers have refinanced from between Jan 1st, 2025, to April 1st, 2025. We use actual encumbrance data in these calculations. This graph is updated quarterly and was last updated on April 1st, 2025.

Fixed 2 years

Tiimely own

Investment • Principal & interest

5.49%p.a.Interest rate

5.58%p.a.Comparison rate

- 5.59% roll-to rate after 2 years

- No hidden fees

- Free online redraw on any additional repayments

- $20,000 additional repayments limit per year

- 20% deposit required

- Up to 30 years loan term

Please note comparison rate might change based on your product selection

Fixed 1 year

Tiimely own

Investment • Principal & interest

5.74%p.a.Interest rate

5.61%p.a.Comparison rate

- 5.59% roll-to-rate after 1 year

- No hidden fees

- Free online redraw on any additional repayments

- $20,000 additional repayments limit per year

- 20% deposit required

- Up to 30 years loan term

Please note comparison rate might change based on your product selection

Fixed 2 years

Tiimely own

Owner-occupied • Principal & interest

5.29%p.a.Interest rate

5.30%p.a.Comparison rate

- 5.29% roll-to rate after 2 years

- No hidden fees

- Free online redraw on any additional repayments

- $20,000 additional repayments limit per year

- 20% deposit required

- Up to 30 years loan term

Please note comparison rate might change based on your product selection

Fixed 2 years

Tiimely own

Owner-occupied • Principal & interest

5.29%p.a.Interest rate

5.30%p.a.Comparison rate

- 5.29% roll-to rate after 2 years

- No hidden fees

- Free online redraw on any additional repayments

- $20,000 additional repayments limit per year

- 20% deposit required

- Up to 30 years loan term

Please note comparison rate might change based on your product selection

Real stories, real savings

Hear from our satisfied Tiimely Home customers on Trustpilot.com

Tiimely own

The different kinds of fees

Get a home loan in 3 easy steps

With a 15 minute online application and fast approvals, getting a home loan is easier than you think.

Check your eligibility

Answer a few questions to see if a Tiimely Own home loan is a good fit for you.

Apply online

It takes 15 minutes to apply. You'll get a decision in minutes or ASAP if we need to jump in manually.

Sign and start saving

If fully approved, your loan docs will be auto-generated and emailed to you. In most cases, within minutes. Then you're ready to celebrate.

Local experts

Talk to a local home loan expert

We pride ourselves on our service. 90% of customer calls are answered within 20 seconds by our Australian-based team.

Have questions? We have answers.

Cashback eligibility

Am I eligible for the cashback offer?

To be eligible for the cashback offer, you’ll need to meet the following terms and conditions:

- You apply for a new 2 yr Fixed Tiimely Own home loan between 18 June 2025 and 31 August 2025

- Applications for a Tiimely Own loan are subject to credit criteria and terms and conditions, fees and charges, and other eligibility criteria apply

- You must settle your home loan by 30 September 2025

- The loan amount you’re applying for must be $500,000 or greater

- You must be purchasing a property to owner occupy or as an investment property

- You are refinancing a home loan from another financial institution (i.e. not from Tiimely Home)

- The offer applies only to the Tiimely Own products noted above, and does not apply where a Tiimely Home broker customer applies for a loan with a panel lender

- You are not eligible for any other cashback from Tiimely Home

- The terms and conditions of this offer may change or be withdrawn without prior notice. Excludes refinance of existing Tiimely Own home loans.

- You must meet Tiimely Home's eligibility criteria

Can I get the cashback if I’m refinancing?

Yes, if you’re refinancing from another financial institution to a Tiimely Own home loan and you meet the terms and conditions outlined above, you can get the cashback.

Can I get the cashback if I’m refinancing an existing Tiimely Own home loan?

The cashback does not apply for refinancing an existing Tiimely Own home loan.

Can I get the cashback if I’m purchasing a new home?

Yes. If your property is eligible and you meet the other terms and conditions outlined above, you can get the cashback. Find out more about our eligibility criteria.

Can I get the cashback if I’m purchasing an investment property?

Yes, you can get the cashback if you’re purchasing an eligible investment property, and meet the terms and conditions outlined above. Find out more about our eligibility criteria.

Is my property eligible?

We’ve outlined our eligibility criteria, or you can enter your address on the first page of our application to see if it’s eligible.

Your loan amount needs to be $500K or higher, and you need to meet the Cashback eligibility too.

Can my partner and I both get the cashback?

The cashback promotion applies to each loan application, not to each individual loan applicant.

Will I get the cashback?

I’ve already applied, do I still get the cashback?

We’re really sorry but our promotional period is only valid for eligible applications submitted between 18 June 2025 to 31 August 2025.

I’m waiting for settlement, do I get the cashback?

We’re really sorry but our promotional period is only valid for eligible applications submitted between 18 June 2025 to 31 August 2025.

My home loan just settled, can I get the cashback?

We’re really sorry but our promotional period is only valid for eligible applications submitted between 18 June 2025 to 31 August 2025.

Can existing customers get the cashback offer?

Existing customers are eligible for the cashback if they’re applying for a brand new home loan + property within the promotional period (i.e. you cannot refinance an existing Tiimely Own home loan).

What if my application expires before the end of the promotion?

To be eligible for the cashback you need to have submitted your application by 31 August 2025 and settle prior to 30 September 2025. If you begin a new loan application outside of the promotion period, you will not be eligible for the cashback.

If I have multiple home loans will I get the cashback for all of them?

If you have applied for multiple 2 yr fixed home loans during the promotional period and they all settle by 30 September 2025 then you will be eligible for a cashback on each loan.

When do I have to apply to get the cashback?

The promotion period starts on 18 June 2025 and ends on 31 August 2025 and your loan must settle by 30th September. (offer subject to termination or change without prior notice).

- To be eligible for a cashback, your bank account details must be received by Tiimely Home within 30 days of settlement

- The Cashback will be credited to your nominated bank account (with the same name as the applicant (s) within 45 days of settlement - subject to prior and timely receipt of bank account details.

- Any cashbacks not received due to incorrect account information provided by an applicant will not be compensated or re-issued.

How will I get the cashback?

How will I get the cash?

We will be in touch when your loan has settled to collect your bank account details. Subject to prior and timely receipt of bank account details, we’ll transfer your $2,000 cashback into your nominated bank account in the same name of the applicant (s) within 45 days of settlement.

-To be eligible for a cashback, your bank account details must be received by Tiimely Home within 30 days of settlement

-Any cashbacks not received due to incorrect account information provided by an applicant will not be compensated or re-issued.

When will I get the cash?

You’ll receive the $2,000 cashback within 45 days of settlement.

How long is the offer going for?

The promotion period will run for from 18 June 2025 to 31 August 2025 and your loan must settle by 30th September. (offer subject to termination or change without prior notice).

To be eligible for a cashback, your bank account details must be received by Tiimely Home within 30 days of settlement

How many times can I get the cashback offer?

You can receive the cashback for each eligible loan application within the promotional period.

How long do I have to stay with Tiimely Home?

As it is a 2 year fixed loan the minimum is 2 years. If you choose to refinance or pay out your loan before the expiry of the 2 year period you will be charged break costs and discharge fees.

Disclaimer

Tiimely Home 2 yr Fixed Cashback Campaign Terms and Conditions

- Apply and be approved for a loan during promotion period 18 June 2025 and 31 August 2025 (‘promotional period’) and settle by 30 September 2025 to receive $2,000 cashback.

- Applications for a Tiimely Own home loan are subject to credit criteria and terms and conditions, fees and charges, and other eligibility criteria apply

- Offer is available to eligible Owner Occupied and Investment customers purchasing a property or refinancing from another financial institution.

- Minimum loan amount $500K.

- This offer is only available per loan (not per applicant).

- Cashback will be credited to your nominated bank account (with the same name as the applicant (s) within 45 days of settlement - subject to prior and timely receipt of bank account details.

- To be eligible for a cashback, your bank account details must be received by Tiimely Home within 30 days of settlement

- Any cashbacks not received due to incorrect account information provided by an applicant will not be compensated or re-issued.

- The terms and conditions of this offer may change or be withdrawn without prior notice. Excludes refinance of existing Tiimely Own home loans.