Sharp fixed rates for investors

From first-time investors to portfolio builders. Secure a great fixed investment rate. Plus, you could get up to $3,000 cashback.*

5.79%p.a.Interest*

5.84%p.a.Comparison^

2 years fixed rate • Investor • Principal & Interest • LVR > 60% and ≤ 70%

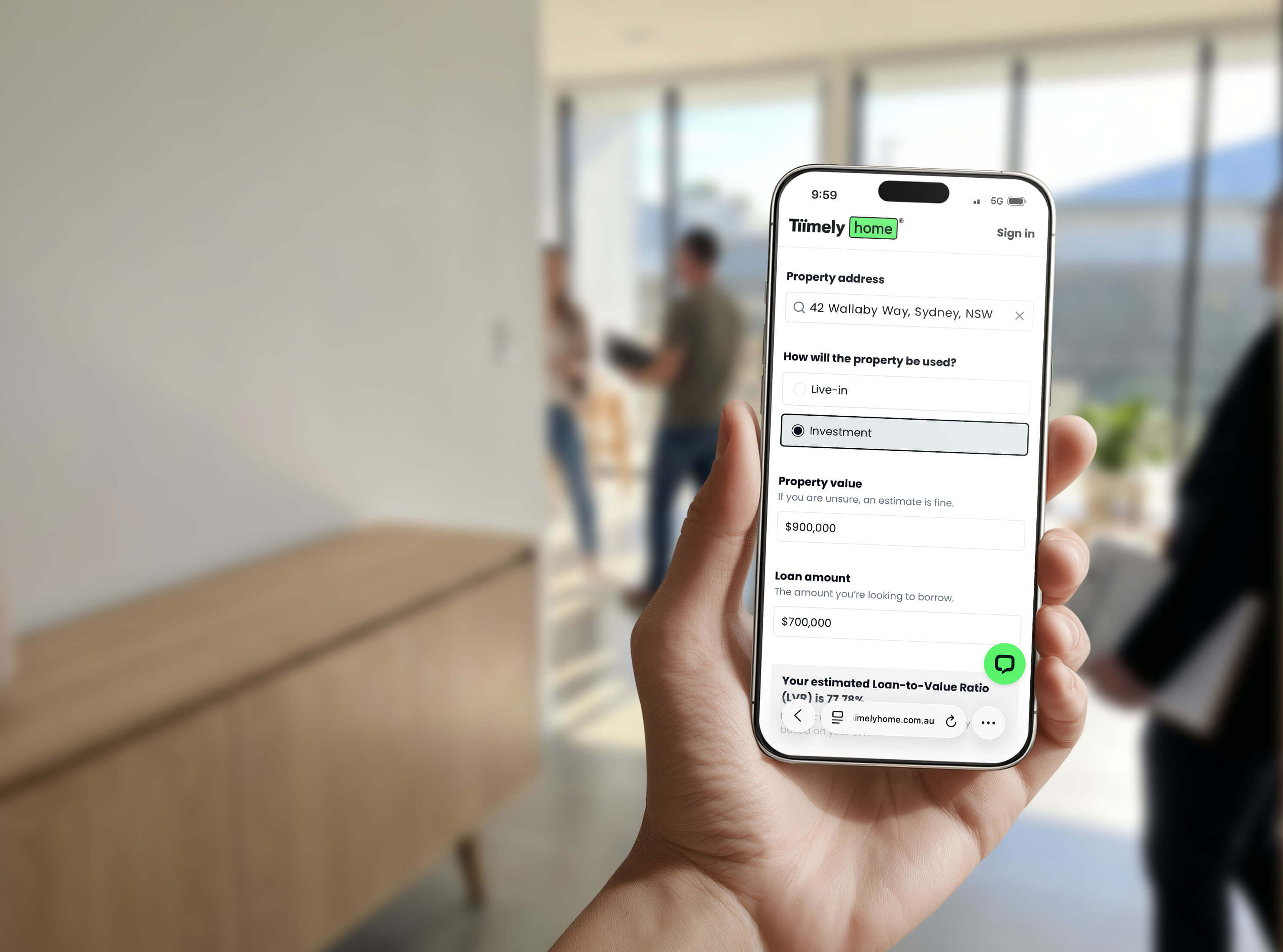

Buying your first home, made less scary

We make home loans transparent with LiveChat customer support and expert mortgage brokers to help you navigate every step.

People love our mortgage brokers

Really, check Trustpilot. You’ll see some very kind words, and we couldn’t agree more.

We’re all about getting you the right home loan.

Whether you're after our Tiimely Own home loan, or looking for something different across our panel of 33 lenders, we are here to support you every step of the way. We’re here to make it simple, transparent, and tailored to you.

Australia's leading online home loan destination.

In 2017, we launched as Tic:Toc Home Loans, introducing The World’s First Instant Home Loan®. A world-first innovation that changed the way Australians fulfilled their home loan.

Since then, we’ve evolved beyond our price and speed proposition. What began as a faster way to get your approval has become something much bigger, to become Australia’s leading online home loan destination. Now as Tiimely Home, we combine our innovation with real human expertise to make every step of the home loan process faster, smarter, and simpler. We are here to support Australians refinance, buy, and invest with confidence.

With access to multiple lenders and our own award winning Tiimely Own product, competitive rates, and expert support all the way to settlement, Tiimely Home is helping thousands achieve their home ownership goals on their terms.

Lowest rates

Access over 30 lenders across a full range of products, gives you options along with the most competitive rates, with no hidden fees or surprises

Choice of home loan options

Buying, refinancing, investing, building or renovating, we will get the perfect loan tailored to you

Fast approvals

Our fastest home loan contract delivered in 58 minutes

Support all the way

Our expert brokers and customer care team guide you from application to settlement

Real customers. Real stories. Real savings.

Don’t take our word for it. Read what real Australians say about their Tiimely Home experience on Trustpilot.

Looking for something different?

Tiimely Own is the smart choice for a low-rate loan with fast approval, but it’s not for everyone. Our in-house broker service provides bank loans from over 30 major lenders and supports complex situations and loan features such as split loans, guarantor loans, and construction loans.

Expert insights and deals straight to your inbox.

Join the Tiimely Home mailing list to be the first to know about our promotions and receive expert tips and industry updates. Unsubscribe anytime.